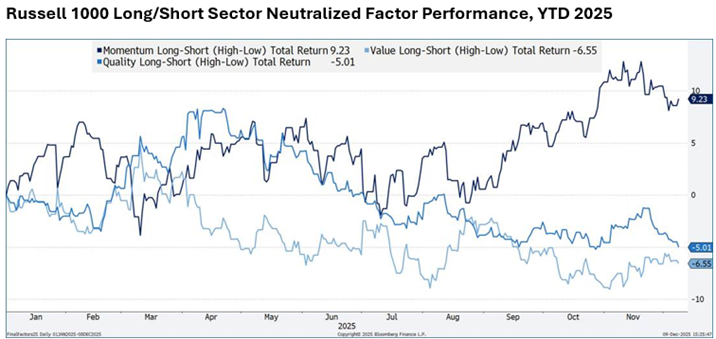

Momentum is the only major factor that is working in the U.S. large cap equity market in 2025, as well as in the bull market that began in 2023. The total return spread between high momentum and low momentum stocks is up 9% so far this year, far outpacing all other factors, which are all down at least 5%. Since the start of 2023, long/short momentum has posted a total return of nearly 20%, and the factor is the only one in positive territory.

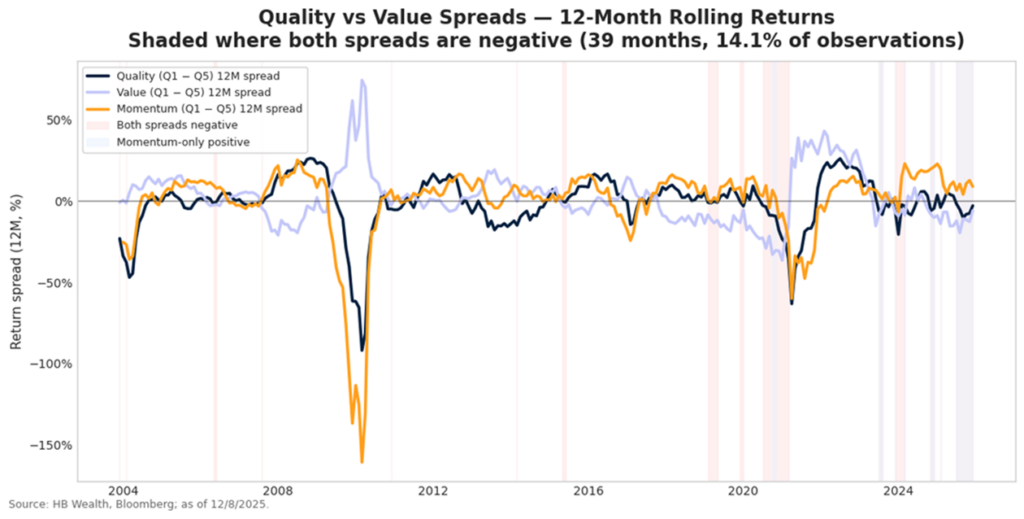

As momentum soars, high quality and low valuation U.S. large cap stocks are underperforming their “tails” (low quality and expensive stocks) by 655 and 500 basis points, respectively, so far this year. On a rolling 12-month basis, expensive, low-quality stocks have been outperforming cheap and high-quality counterparts since October 2024.

Quality and value factor correlations have shifted materially from pre-pandemic norms. Prior to the pandemic, these two factors were negatively correlated – quality worked when value didn’t, and vice versa. That has changed. In momentum’s world, quality and value factors’ fates have become rather intertwined.

HB Wealth is an SEC Registered Investment Adviser and the information provided is for informational purposes only and should not be construed as investment advice or a recommendation to buy or sell any security, cryptocurrency, or other financial instrument. Digital assets, including cryptocurrencies, are highly volatile and may not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk, including the possible loss of principal. The views expressed are those of the author and do not necessarily reflect the opinions of HB Wealth. Comments for this post are not monitored. Please consult your financial advisor before making any investment decisions.