The equity market is enthusiastic about prospects for AI spending to remain a primary driver of earnings growth, and while a cooldown in valuations may be needed to keep expectations from getting too far detached from reality, both investment trends and stock multiples are less extreme than they were in the turn of the century tech bubble in the U.S. Contrary to the years-long tech capex extremes during the 1990s, AI-related spending may just be getting started, and valuations remain well below those bubble-era peaks.

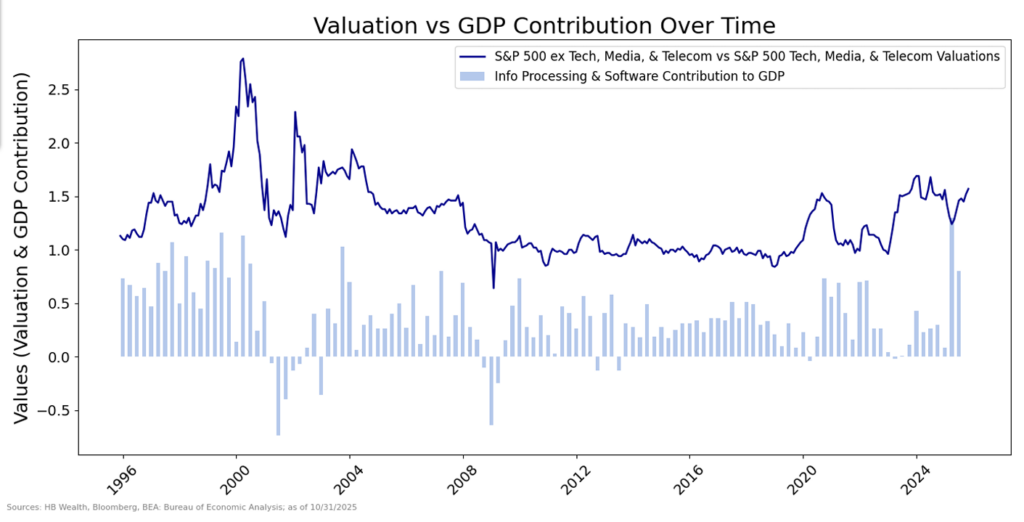

While valuations for large cap AI-focused tech stocks are high relative to much of the recent past, their premium to the rest of the market remains limited compared to the premium that developed in the late-1990s tech boom. U.S. large cap tech and communications stocks trade at a trailing P/E multiple of 34.7x – high compared to their post-pandemic average of 28.3x, but still only about half the peak multiple reached in 2000. Now valued at 1.5 times the rest of the S&P 500, the group traded at 2.8 times their large cap counterparts in 2000. Likewise, the 4 major “AI Hyperscalers” – Microsoft, Alphabet, Meta and Amazon – trade at an average 30.3 times trailing earnings, a far cry from the 80X level the “Four Horsemen” – Cisco, Microsoft, Dell and Intel – traded to by 2000.

Meanwhile, investment has packed a stronger punch to GDP, but it has been underway for a much shorter time than the buildup to the tech bubble. On average over the last 20 years, investment accounted for 0.31 percentage points of growth in GDP quarterly, but in the first half of 2025 it averaged more than a full percentage point of growth, comparable to the norms last set in the late 1990s. The 1990s high level of investment contribution went on for 4 years, however, where the AI-capex boom has been arguably only become extreme for the last few quarters.

The “AI-Hyperscalers” are in aggregate on track to spend around $380 billion in 2025, and have committed to spending $1.7 trillion by 2030, suggesting investment is likely to remain a robust contributor to economic growth. Until these entities signal a significant slowdown, enthusiasm is likely to remain. And as AI-investment among the few morphs into AI-utilization among the many, the AI-theme may continue to offer ballast to profits and support high expectations embedded in stock markets.

HB Wealth is an SEC Registered Investment Adviser and the information provided is for informational purposes only. Additionally, the information should not be construed as investment advice or a recommendation to buy or sell any security or other financial instrument. Past performance is not indicative of future results. Investing involves risk, including the possible loss of principal. The views expressed are those of the author and do not necessarily reflect the opinions of HB Wealth. Please consult your financial advisor before making any investment decisions.