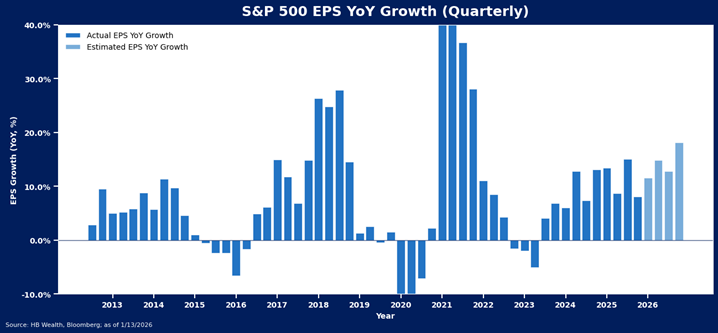

Analyst expectations for about 8% growth in S&P 500 EPS in the fourth quarter earnings season appear likely to be easily beaten, but the forecast for the index to accelerate the pace and end 2026 with nearly 20% EPS growth remains up for debate. Likewise, our macro model suggests the market is priced for even stronger growth than the analyst community anticipates. Thus, the onus will be on companies to set an optimistic tone in the reporting season now underway. We will be watching three major sector themes – tech’s hat trick, financials’ valuation party, and consumer sectors’ revival – to confirm or deny lofty expectations in the weeks ahead.

Hat Trick for the Tech Sector?

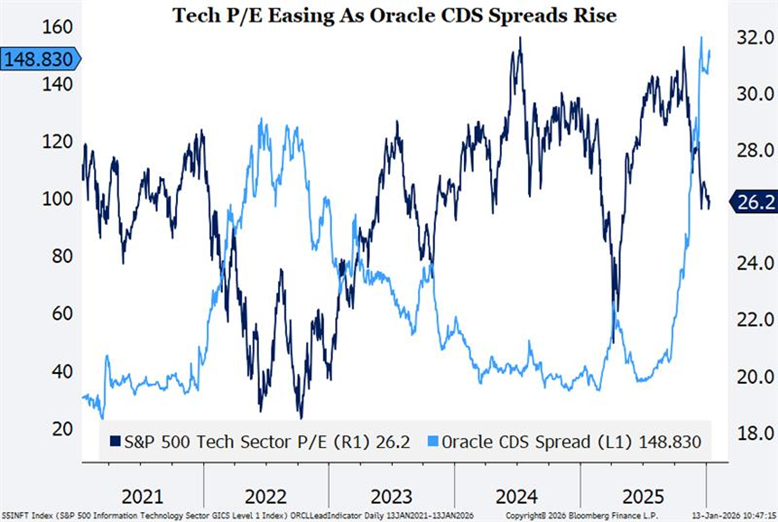

The tech sector has tripled the pace of earnings growth for the rest of the S&P 500 for the last two years and is expected to do so again, with consensus forecasting 30% tech sector net income growth, 3X the 10% growth for the rest of the S&P 500 in 2026. These lofty expectations are notably supported by a hefty margin gain – tech sector operating margins are forecast to rise to a record high 37.6% while net income margins are forecast to surpass 30% for the first time ever. With the bond market getting increasingly nervous about the sector’s ability to sustain the pace of capital spending with debt funding (see Oracle CDS spreads at levels last touched in 2008!), tech’s expected hat trick may be tough to pull off in the year ahead. Companies will need to confirm that AI is getting implemented at a rapid pace, and they won’t need to stretch much to fund its ongoing deployment.

Financials Party Like its 2007?

The consensus expectation for financials appears relatively sanguine, at anticipated 9% growth in 2026 to mimic 2025’s result, but what is priced in the market is more optimistic. Valuations, both on a price to earnings and price to book basis, are at twenty-year highs, and well north of levels touched in the sector’s pre-financial crisis heyday. This suggests even though analysts may be somewhat cautious, the market is expecting something of a boom for the sector. As the yield curve is still rather flat, the onus may be on regulatory reprieve, trading activity and investment banking transactions to justify the sector’s valuation burden this year. Recent comments from the U.S. President on regulation of housing activity and credit card rates could suggest expectations for a broad regulatory reprieve may be particularly questionable.

Consumer Revival?

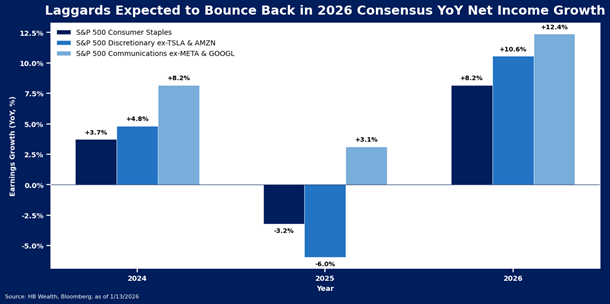

There is a notable disconnect between consumer sentiment – still near all-time lows – and expectations for a consumer spending revival to emerge in S&P 500 sectors in 2026. Three of 2025’s biggest laggards – consumer staples, consumer discretionary and communications – are all expected to stage a remarkable turnaround on the foundation of lower interest rates and the deployment of tax refunds in 2026. Consumer staples and consumer discretionary (excluding Amazon and Tesla) posted net income declines in 2025 and are expected to post 8.2% and 10.5% growth in 2026, while the communications sector (excluding Alphabet and Google) is expected to post 12.4% growth, tripling 2025’s 3.1% pace. Consumers will need to shake off their sour mood and spend at a faster pace to support the consensus expectation for growth this year.

Disclosure: The information reflects the author’s views, opinions, and analyses as the publication date. The information is provided for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any investment product. This information contains forward-looking statements, predictions, and forecasts (“forward-looking statements”) concerning the belief and opinions in respect to the future. Forward-looking statements involve risks and uncertainties, and undue reliance should not be placed on them. There can be no assurance that forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. The information does not represent legal, tax, accounting, or investment advice; recipients should consult their respective advisors regarding such matters. Certain information herein is based on third-party sources believed to be reliable, but which have not been independently verified. Past performance is not a guarantee or indicator of future results; inherent in any investment is the risk of loss.