The jobs market has signaled a weak economy for years, even as other indicators such as corporate profits suggest the economy is holding up reasonably well. This may help explain why consumer confidence remains near record low levels, even as the stock market is at record highs.

The unemployment rate has been on the rise since mid-2023, and now stands at 4.4%, 60 basis points above its record low reached more than two years ago. There is no other instance in history since 1960 in which the unemployment rate rose for two years outside of recession. Prior to 1990, recessions were largely coincident with the start of the rise in unemployment, but since then, the rate rose an average of 9 months and by 35 basis points from its low by the time recession was underway.

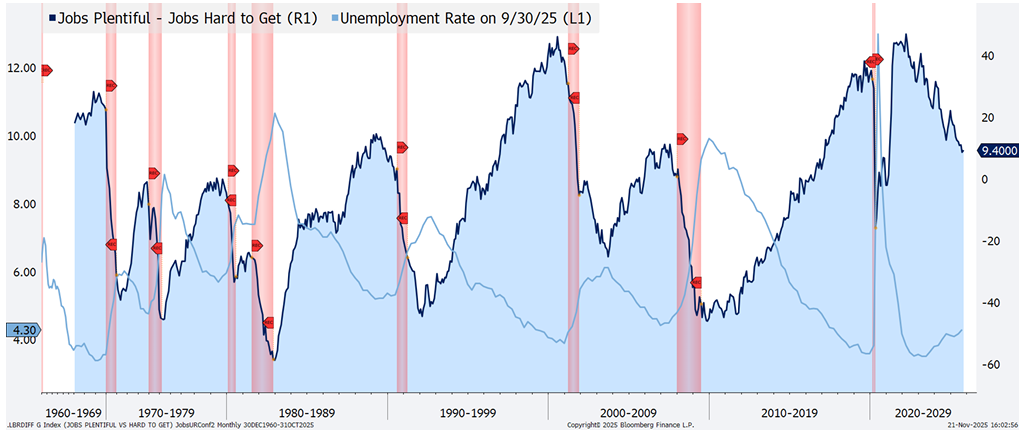

Likewise, the Conference Board’s Consumer Confidence survey shows that “Jobs Hard to Get” has been gathering momentum relative to “Jobs Plentiful” since early 2022. While the differential between the two series is still positive, the directional change of the difference has historically been a more accurate cue for recession timing. On average, recessions have emerged within 8 months of peaks in the difference.

HB Wealth is an SEC Registered Investment Adviser and the information provided is for informational purposes only. Additionally, the information should not be construed as investment advice or a recommendation to buy or sell any security or other financial instrument. Past performance is not indicative of future results. Investing involves risk, including the possible loss of principal. The views expressed are those of the author and do not necessarily reflect the opinions of HB Wealth. Please consult your financial advisor before making any investment decisions.