In prior blogs in this HB Family Office series, we have talked about the definition of a family office, the SFO (single-family office) vs. MFO (multi-family office) approach for receiving these services, and some of the things to think about when considering whether to build your own SFO, use an MFO firm or do something in between.

If you have decided to explore MFO firm options, how do you know whether the MFO you are talking with is a true family office service provider? Many financial service organizations like to use the title family office, but can they really deliver the same experience of an SFO?

True Expertise

No one person can truly be an expert in everything – does the MFO firm have in-house professional expertise beyond the “master generalist advisor” role to go deep on the most critical topics affecting family office clients such as estate planning/wealth transfer strategies, complex tax knowledge, risk management strategies, and complex portfolio management? We believe this is a critical part of the true MFO firm offering.

Advice Integration

Some MFO firms offer extensive services on paper, but how many of their lead advisors have the experience of truly leading a complex family office team and advising sophisticated families? How well can they integrate advice from all the technical components of the family financial picture (legal, tax, business, investments) as well as the practical day-to-day components of the family dynamics? There is an art to managing complex families that goes beyond pure science, and a true MFO firm has experience balancing all the above.

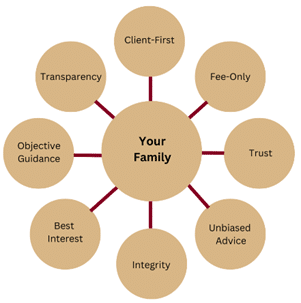

A single-family office team working for you will absolutely be focused on making all decisions based on the best interest of the family (or they will be fired!). If you are talking to a bank or wirehouse broker team, they may not actually be serving you under the fiduciary standard that all SEC-registered investment advisers must follow. Verify that your team will always be serving your best interests – not just sometimes – using the fiduciary standard.

Beyond Fiduciary—Avoiding Conflicts of Interest

Even firms that adhere to fiduciary standards may not be completely aligned with your interests. While advising you on investments, insurance, lending, or other financial products or services, they may also be providing those same products or services for a profit. If you hired a full-time staff of employees for your own single-family office, would you also let them make money off their recommendations to you on financial matters? From a professional perspective, it is difficult to understand why any MFO firm would introduce these conflicts into discussions, even if they assert themselves as genuine fiduciary advisors. At HB Family Office, we prioritize traditional fiduciary responsibilities by actively seeking to mitigate potential conflicts of interest. This approach allows us to maintain complete transparency and focus solely on serving our family office clients.

HB Family Office was founded in 1989 with a singular focus – what firm would our clients create if they were designing their ideal wealth advisor? This is why we describe our services as “Wealth Management Built For You®.” We encourage you to weigh all these important considerations as you evaluate family office options. As we have mentioned many times throughout this blog series, there is no ‘silver bullet’ or ‘one size fits all’ solution for all families. If you are curious if a family office solution might be right for your family, please consider us a resource to help navigate the process and discuss how HB Family Office could help meet your unique needs.

To learn more about a family office, please visit us at https://hbwealth.com/resources/understanding-family-offices/, send an email to info@hbwealth.com, or call 404.264.1400.

Important Disclosures

This article may not be copied, reproduced, or distributed without Homrich Berg’s prior written consent.

All information is as of the date above unless otherwise disclosed. The information is provided for informational purposes only and should not be considered a recommendation to purchase or sell any financial instrument, product, or service sponsored by Homrich Berg or its affiliates or agents. The information does not represent legal, tax, accounting, or investment advice; recipients should consult their respective advisors regarding such matters. This material may not be suitable for all investors. Neither Homrich Berg nor any affiliates make any representation or warranty as to the accuracy or merit of this analysis for individual use. Information contained herein has been obtained from sources believed to be reliable but are not guaranteed. Investors are advised to consult with their investment professional about their specific financial needs and goals before making any investment decision.

©2025 Homrich Berg.

Market Sense – A Deep Dive: Will Global Stocks Shine Again in 2026?

International shares outperformed US large cap stocks by the most since 2007, and developed markets…

Read More