Private Markets: Are They Right for Your Portfolio?

A Primer On Private Market Investment Opportunities

More accessible than ever, nontraditional investments such as private investments, sometimes referred to as alternatives, or “alts,” are becoming popular among individual investors.

We’re here to help you understand 1) the opportunities in private alternative investments and 2) how HB Wealth can help you navigate this complex category to find the potential fits for your portfolio.

Download the e-book

Introduction

Higher inflation rates. Economic uncertainty. Global instability. These are unprecedented times for investors. As movement in bond yields and high stock market volatility challenge traditional portfolios, investors are looking to diversify. They seek innovative solutions that offer the potential for higher growth, higher yields, stronger absolute returns and less volatility. They understand that this comes with the tradeoff of having less liquidity than traditional stocks and bonds.

Enter private market investments.

More accessible than ever, nontraditional investments such as private investments, sometimes referred to as alternatives, or “alts,” are becoming popular among individual investors.

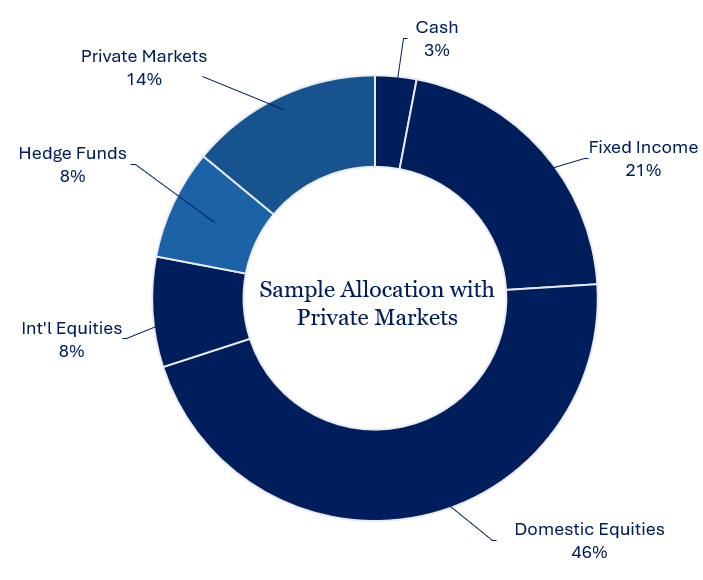

That’s because these investment solutions may enable clients to address their capital-appreciation and income objectives while enjoying a measure of protection against inflation. A complement to traditional equity and fixed-income investments, private investments (which have less liquidity than traditional investments) can also help improve diversification, increase return potential, and manage the volatility.

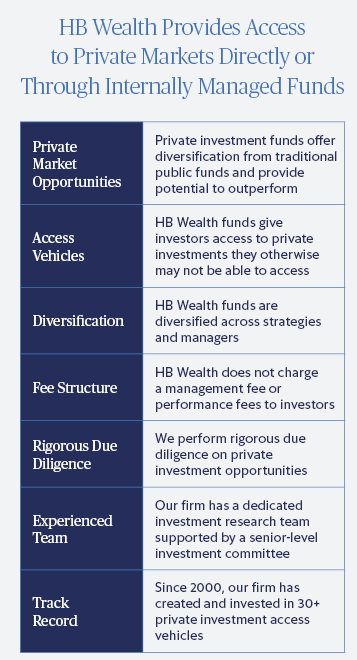

Still, some believe private investments are available only to institutional investors or a select set of ultra-high-net-worth clients. At HB Wealth, however, we seek out a range of opportunities to help our clients achieve their investment goals and consider private investments as a fundamental part of most client portfolios.

“Private investments can provide many potential benefits to investors, with the ability to diversify away from public markets and the potential to increase investment returns over the long term,” explains Managing Director of Private Investments, Zach Ruchman, who oversees HB Wealth's sourcing, due diligence and manager selection for private alternative asset classes.

“Private investments can provide many potential benefits to investors, with the ability to diversify away from public markets and the potential to increase investment returns over the long term.”

What Are Private Investments?

Simply put, we define alternatives broadly as opportunities that are not publicly traded on an exchange. While public managers own the equity (stocks) and debt (bonds) of public companies, an entire universe of managers within alternatives do this with private companies and assets.

As such, private investments provide investors opportunities that might not be readily accessible via the public markets-if they are comfortable with the illiquidity risk of these investments. In addition, since private investments can be less correlated to traditional asset classes, they can have greater diversification potential in the context of a total portfolio.

Private investments can include:

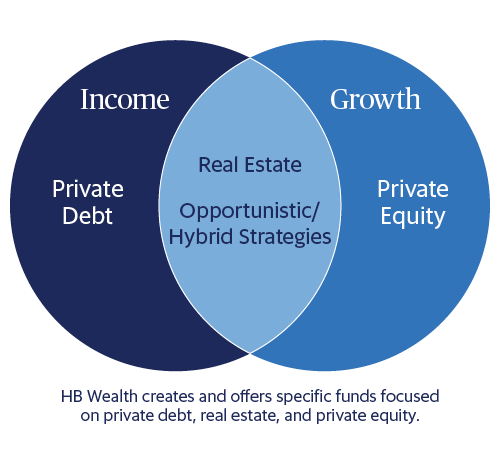

- Real Estate Investments

- Private Equity Funds

- Private Energy Funds

- Private Debt Funds

- Hedge Funds

- Venture Capital Funds

- Distressed Opportunity Funds

Why Private Investments Are Expanding

A number of trends are contributing to the growth of private investment opportunities.

1. Privately held versus publicly traded.

Private companies are now a larger part of the economy, creating more opportunity for private equity investors. In 1996, more than 7,400 companies were listed on U.S. stock exchanges.¹ Today, that figure is less than half that, as many more companies choose to remain private. Just as the number of publicly traded companies has fallen, the number of private firms has risen dramatically. With public markets shrinking and private markets growing, more wealth creation is taking place outside of public markets. Private investments provide access to these firms and expand investors’ options.

2. Performance benchmarking and return expectations.

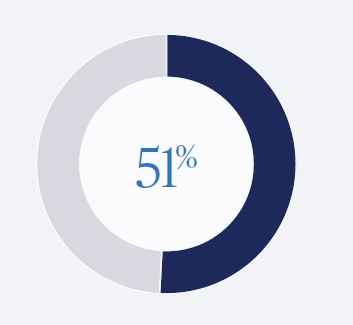

Throughout 2021, private investments demonstrated their ability to weather economic volatility and manage risk while producing returns that met or exceed investor expectations. According to the 2021 EY Global Alternative Fund Survey, more than half (51%) of investors surveyed report increasing value delivered by alternative fund managers in the last two to three years, with investors overwhelmingly indicating that alternatives met or exceeded their return expectations.² Across alternatives, an average of 86% of investors said performance had met or exceeded expectations in 2021.³

3. Growing appeal.

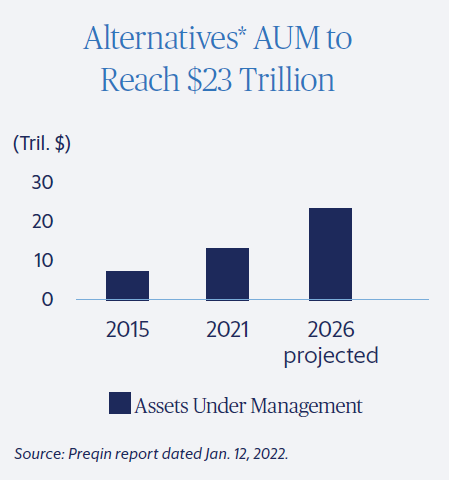

With that, the appeal of private investments continues to grow. Of those surveyed by EY, 81% of ultra-high-net-worth investors (net worth of $30 million), 55% of high-net-worth investors and 14% of the mass affluent now hold alternative investments. Alternative assets fund managers, who currently hold more than $13 trillion in assets under management, are expected to hold $23.21 trillion by the end of 2026, according to Preqin’s 2022 Global Alternatives Reports.4

The magnitude of rising individual investor allocations toward alternatives supports our desire at HB Wealth to expand our clients’ access to private market investments.

1 https://www.wsj.com/articles/fewer-listed-companies-is-that-good-or-bad-for-stock-markets-1515100040

2, 3 https://www.ey.com/en_us/insights/wealth-asset-management/can-the-difference-of-one-year-move-you-years-ahead. Past performance is not a guarantee of future results.

4 https://www.preqin.com/insights/research/reports/alternatives-in-2022

*Private market investments in private funds or other private securities are only available to accredited and/or QP investors who meet certain suitability requirements.

…more than half (51%) of investors surveyed report increasing value delivered by alternative fund managers in the last two to three years…

Why Invest In Private Investments

While private investments can be riskier on a stand-alone basis, investors can be rewarded for this risk with higher returns to capture an “illiquidity premium.”

Ruchman believes privates have the potential to reduce volatility within a portfolio because the fundamentals of many private assets, such as private companies or real estate properties, “might not be highly impacted by the day-to-day changes in public markets.”

Because of how private funds are generally structured, he explains, investors can take a longer-term approach to maximizing asset value, “particularly with private equity and private real estate,” says Ruchman. “Private market investments tend to be active, buy-and-hold strategies with a hands-on approach, whereas public markets can be highly influenced by shorter-term events. For example, a public company that fails to hit its quarterly projections may see its stock drop.”

“Private market investments tend to be active, buy-and-hold strategies with a hands-on approach, whereas public markets can be highly influenced by shorter-term events.”

What To Consider Before Investing

Manager Selection. While liquidity is an important factor, so is manager selection. “In public markets, we believe the dispersion of returns among managers with the same intended strategy or benchmark won’t be significant,” says Ruchman. “However, in private markets, your returns can vary considerably, because the dispersion might be substantial between top-quartile and bottom-quartile managers.” Investments should only be made with institutional managers who have appropriate guardrails in place via their legal documentation. Also, firms that offer alternatives to their clients should have dedicated resources to sourcing and performing due diligence on alternatives managers, as “private investments are so nuanced and different from public market offerings,” he adds.

Sourcing and Due Diligence. Firms must also know how to source opportunities. “Several thousand private funds are in the market at any given time, so the top of the funnel is very wide,” says Ruchman. “To whittle down the vast universe of managers to a short list of highest-conviction managers requires a deep network, vast experience, and years of pattern recognition” Because it’s so time-consuming and resource intensive, HB Wealth dedicates significant resources to researching and analyzing this area of the market precisely.

Investment Minimums. Scale also matters. Some private managers might require minimum investments of $5 million to $10 million. Because HB Wealth has accumulated years of relevant experience and manages over $28 billion in assets, it can access multiple avenues to reach higher minimums and become more meaningful to managers. “We create access vehicles for clients, which allows us to make one larger commitment to managers by aggregating capital from many clients.”

HB Wealth And Private Investments

Our firm started investing in private market investments in the early 1990s and has grown to be one of the leading independent RIA firms focused on these investments. HB Wealth has committed several hundred million dollars to private markets each year for the past several years. The amount of client assets under management that are invested in private markets is $4 billion+.*

We have a dedicated team of investment analysts who source, evaluate and monitor private investments. All of our investment professionals have focus areas where they lead the research and monitoring effort and are members of our Investment Committee. In addition, multiple principals are CFA charter holders and participate as members of the Investment Committee.

We have access to a wide range of institutional brand name firms as well as smaller niche players, including funds on the platforms of other wealth managers.

Our Private Investment Experience

Because we are a fiduciary independent firm, our clients know that our recommended investments—which can range from large institutions to small niche players and funds on the platforms of other wealth managers—are not driven by a motivation to “sell” a specific investment. We are never financially incentivized to recommend one investment over another, so our sole focus is to invest with the managers we believe have the greatest potential to generate the best net-of-fee, risk-adjusted returns for our clients.

For clients who might not meet the minimums of some private funds, we assemble internal access vehicles (with no extra management fee or incentive fee of any kind) for our clients to help them invest in a diversified portfolio of alternative strategies.

We also manage a multi-strategy hedge fund access vehicle (Peachtree Alternative Strategies) for when the inclusion of a more “absolute return” type of strategy makes sense in a client’s diversified portfolio.

HB Wealth clients do not pay extra management fees for these funds, and our firm has no financial incentive for clients to invest in them. We have created over 30+ investment access vehicles since 2000 with 100+ manager relationships inside those funds.

*Data as of August 31, 2025

How We Implement Private Investments

- At HB Wealth, we segment private investments into those that we feel are more growth-oriented and those that are more income-oriented, which often include a current yield component.

- We work with each client to understand how best to implement alternatives into the overall financial plan. Depending on the client situation, investment options may differ. This includes understanding whether the client is an Accredited Investor, a Qualified Client, or a Qualified Purchaser, as defined by U.S. securities laws.

- We invest across the private investment spectrum. Our dedicated investments team performs due diligence on managers and brings its most compelling ideas to the firm’s investment committee for approval.

Conclusion

With the potential for heightened public market volatility in both stocks and bonds, investors who are willing to take on some illiquidity risk with some of their assets should consider private investments as a potential source of yield, diversification, or capital appreciation—or a combination of all three. Private investments have always been a tenet of HB Wealth's investment philosophy, and we believe they are as relevant today as they have ever been.

Liked this explanation? Download the e-book version to keep or to share with your financial advisor.

About Us

Founded in 1989, HB Wealth is a national independent wealth management firm providing fiduciary, fee-only wealth advisory services, investment management, and family office services. As one of the country’s largest fee-only registered investment advisers (RIAs), HB Wealth is headquartered in Atlanta with more than 300 employees operating out of 11 offices across five states, managing over $28 billion for individuals, families, and institutions. With a mission of bringing unwavering financial peace of mind to the clients we are privileged to serve, HB Wealth delivers comprehensive advice and concierge-level care through a fee-only approach. Think of it as the fiduciary standard, elevated.

Private market investments are not for every client. You must be qualified to invest in a private investment based on your net worth and/or other criteria, and you may qualify to invest in some private investments while not be allowed to invest in other private investments. Private investments are not risk-free and there is no guarantee of achieving superior performance compared to similar liquid investments. Past performance is not a guarantee of future results for any investment. Please consult your HB Wealth client service team to determine if private investments are suitable for your overall investment portfolio, and to determine the appropriate allocation to private market investments if used in the portfolio.